My Favorites

Most people think pre-foreclosure means the end of the road. You know better—it’s the start of a conversation.

Right now, foreclosures are rising across the country. And while headlines spark panic, your role is to bring clarity. This letter is designed to do exactly that:

• Bust common myths that prey on vulnerable homeowners

• Reframe pre-foreclosure as a moment for informed decisions—not rushed ones

• Position you as a steady, experienced guide with real solutions

Use this campaign to offer what most won’t: options, empathy, and a way forward that protects your clients' peace of mind—and their equity.

In uncertain times, most people hit pause. The smartest agents? They press in.

This text is a low-pressure way to re-open conversations with people who’ve stepped back. It acknowledges what everyone’s feeling—without adding to the noise. Use it to:

• Create space for casual, judgment-free dialogue

• Offer a steady voice in a noisy market

• Signal that real movement is still happening

It’s not about pushing people to act—it’s about reminding them you’re here, paying attention, and ready when they are.

Silence isn’t strategy—it’s a missed opportunity.

This text gives you a simple way to re-engage people who’ve gone quiet. Right now, many are quietly watching the market, unsure whether to move forward or stay put. Your job? Open the door. Offer clarity. And make the next step feel less overwhelming. Use this script to:

• Gently restart paused conversations

• Create space for honest, pressure-free dialogue

• Position yourself as the go-to guide in uncertain times

It’s not pushy. It’s proactive. And that’s what makes it effective.

Confusion isn’t the enemy—silence is.

Right now, your clients don’t need all the answers. They need a trusted voice to help them make sense of the noise. This campaign is your opportunity to step in with calm, credible guidance at a time when most agents are staying quiet. Use it to:

• Acknowledge what buyers and sellers are really feeling

• Highlight what’s actually happening—rates, inventory, demand

• Reopen conversations that were paused out of fear or fatigue

Don’t wait for the market to “settle.” Show up for people now.

Most agents wait for certainty before they speak up. The best ones? They lead through it.

This campaign is designed for moments like this—when buyers and sellers are quietly re-evaluating, unsure whether to make a move or stay put. You have a short window to step in with clarity and confidence. Use this message to:

• Reignite conversations that have gone quiet

• Reframe what’s possible in the next 90 days

• Reposition yourself as the steady hand clients are searching for

It’s not about predicting the future. It’s about helping people make sense of the present.

This script was inspired by Olga Moreno’s “8 HUGE Changes Coming to Las Vegas in 2025!!” video—which pulled in over 18,000 views. Not because she went viral. But because she nailed what so many agents miss: people want the big picture.

This isn’t a market update. It’s a narrative.

It gives context to all the local change your audience is seeing—but not fully understanding. It answers the question behind the question: What’s happening in this city, and what does it mean for me?

Here’s how to make it work:

- Start strong—mention the city, the year, and why this matters now.

Use stats or headlines sparingly—this is about momentum, not overload. - Think like a tour guide. You’re not just selling homes—you’re showing them what’s coming.

And remember: people don’t just want listings. They want to follow someone who’s plugged in, paying attention, and thinking ahead. This video positions you as exactly that.

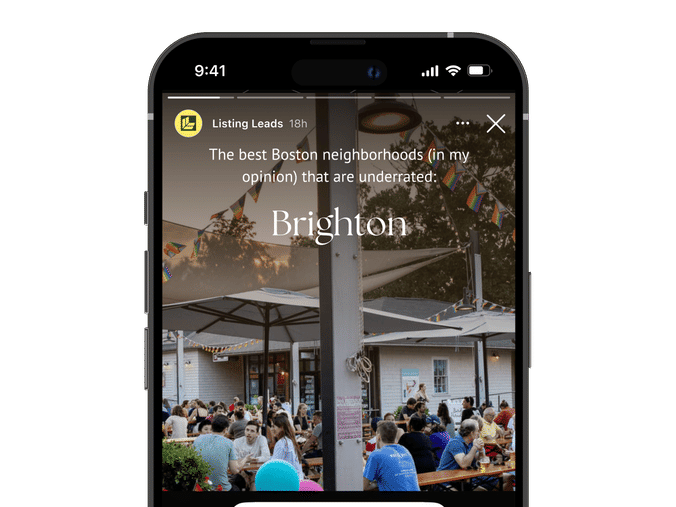

Not every post needs to be a pitch. In fact, some of the most powerful content doesn’t sell—it connects.

This Story is about starting light, local conversations that build trust over time. You’re not pushing a property. You’re inviting people into your perspective—sharing the neighborhoods you love, and asking them to weigh in.

Here’s why it works:

- It feels casual, not calculated.

- It taps into local pride and curiosity.

- It gives followers an easy reason to reply—without feeling like they’re walking into a sales convo.

Think of this as your “talk of the town” moment. Personal, relatable, and perfectly positioned to keep you top of mind.

Many homeowners are feeling the weight of today's economic uncertainties. With concerns about rising prices and financial stability, understanding one's home equity becomes crucial. This script is crafted for personalized, one-on-one outreach to prospects, offering them clarity amidst the financial fog.

By proactively addressing these economic concerns, you position yourself as a knowledgeable and trustworthy advisor, ready to guide clients through uncertain times.

Most agents ignore tax season. Smart ones use it to spark conversation.

When those new assessment letters hit mailboxes, homeowners do one of two things: shrug it off—or wonder if they’re getting overcharged. This campaign is built for the second group.

It positions you as the local expert who can translate inflated tax values into real-world numbers—and potentially real savings.

Use it to:

- Start value-based conversations without pushing a sale.

- Offer a helpful, relevant service that builds trust fast.

- Reconnect with past clients and neighbors in a way that feels timely and valuable.

Most agents wait for sellers to raise their hand. Top agents create the moment.

Right now, one of the most overlooked seller opportunities is hiding in plain sight: mortgage renewals. Thousands of homeowners are approaching renewal dates—and they’re quietly questioning whether staying put still makes financial sense.

This campaign meets them right there, in that moment of uncertainty.

Here’s how to use it to spark listing conversations:

- Lead with service—offer personalized insight, not a generic sales pitch.

- Frame the home equity report as a decision-making tool, not a valuation.

- Open the door to bigger conversations about upgrading, downsizing, or refinancing.

Most agents default to “now is a great time to buy”—but savvy buyers aren’t buying it.

They’ve seen the headlines. They know affordability is out of whack. What they don’t know is how to make sense of it all—or how to apply it to their own timeline. That’s the gap this campaign is built to fill.

This isn’t about hype. It’s about helping your clients zoom out, think long-term, and make a smart move based on their goals—not market noise.

Use this message to reset the conversation:

- Shift the narrative from timing to timeline.

- Show them how national data actually supports their local decision.

- Position yourself as the clear-thinking, truth-telling guide they’ve been looking for.

This postcard is designed to hit at just the right time—when competition is fierce and sellers are starting to pay closer attention.

In many markets right now, demand is surging. Homes are selling over asking, often with multiple backup offers and no contingencies. But most homeowners don’t fully realize just how competitive things have gotten in their neighborhood.

That’s the power of this piece—it delivers hyper-local proof that now might be their moment.

Customize it with your latest market data. Plug in a recent win and testimonial. And make sure your call-to-action is easy to act on—because when sellers see what’s happening nearby, they’re more likely to raise their hand.

Direct questions make people hesitate. Strategic statements make them lean in.

This campaign is built around the Elicitation Tactic—a psychology-backed approach where, instead of asking, you suggest. It’s subtle, but powerful. Because when people aren’t being pushed, they’re more likely to engage.

You’re not asking, “Would you sell?” You’re planting a thought:

“Wondering if there’s a number that would make the conversation worth having—even if selling wasn’t your plan for this year.”

It’s non-threatening. Emotionally intelligent. And perfect for sellers who aren’t raising their hand—but might be open, given the right offer.

This week’s email is grounded in insights from RBC’s latest housing report and recent coverage from The Globe and Mail. Together, they capture a clear mood in the market: caution.

National resales fell nearly 10% in February—the sharpest monthly drop in years. But that stat alone doesn’t tell the whole story.

Because in a cautious market, people don’t stop moving. They just move differently.

This email helps you communicate that nuance—to show up as a calm, informed resource in a time when many are feeling uncertain.

This week’s email pulls from two of the most respected sources in housing data—Altos Research and ATTOM. Together, they paint a picture that’s more complex than the headlines suggest.

It’s a national view—but one that helps you frame local conversations with more clarity and confidence.

Because even when your market behaves differently, buyers and sellers are still hearing national narratives. Your job is to bring perspective.

Here’s what the latest numbers show—and how to use them to educate, inform, and stay relevant.

This template also includes a direct-response P.S. designed to surface potential sellers—so you can spark the right conversations at the right time.

Most agents wait until someone says, “I’m ready to move” before they start the conversation.

But the truth? Serious sellers show up months earlier—with questions, hesitations, and quiet curiosity.

That’s where this poll comes in.

It’s not just engagement—it’s early detection.

- You’ll surface potential movers before they hit the market.

- You’ll position yourself as the go-to guide, not the last-minute call.

- And you’ll gather real-time feedback from your actual audience—not a generic market report.

Use it to spark low-pressure conversations—then follow up with a simple DM to open the door.