Email Campaigns

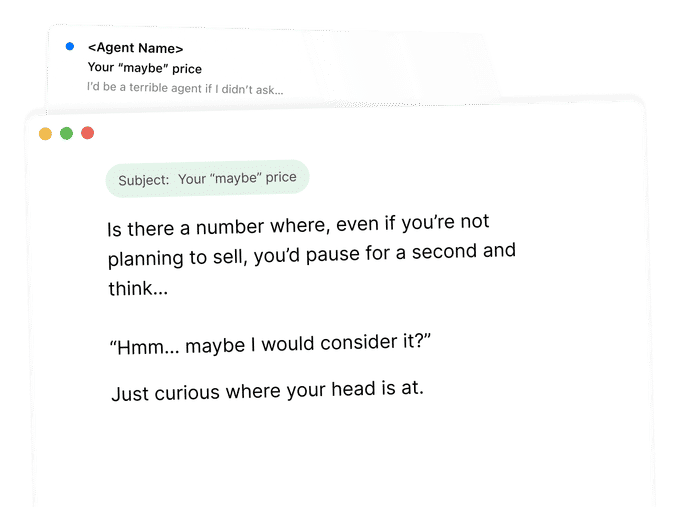

We call this a “fast ball” email because it’s quick, clean, and built to get replies.

It leads with empathy. It sounds personal, even off-the-cuff. And it mirrors the exact conversations many agents are already having right now, where people want to move but feel frozen by uncertainty.

The format is simple on purpose: A short, genuine note that puts a few common scenarios on the table and invites the reader to raise their hand. That’s it.

Let’s get it out there.

This campaign has generated millions of dollars in listing appointments. It's the incredibly popular Name Your Price campaign.

Here's a pro-tip: This tactic was originally designed to be an email campaign but really smart agents are leveraging it as a direct mail piece as well.

When an idea works, extend it to other channels.

Always double down on your winners.

When interest rates so much as wobble, buyer psychology shifts. Not always in ways you can predict—but often in ways you can use. A modest dip doesn’t just increase affordability. It gives fence-sitters permission to act.

With the Bank of Canada’s next rate announcement coming July 30, now is the time to steady your message.

This email helps you do just that—calmly, confidently, and with purpose.

Send this email today and include a soft P.S. to invite the right people into a conversation without pressure.

A subtle shift in rates can unlock serious momentum.

When mortgage rates ease—even slightly—buyers don’t just gain affordability. They gain confidence. According to Redfin, a recent dip from 7.08% to 6.67% gave buyers with a $3,000/month budget $16,000 more in purchasing power—enough to afford a $455,000 home instead of $439,000.

That kind of shift can often spark renewed energy: faster tours, fewer concessions, more decisive offers.

Send this email today and include a soft P.S. to invite the right people into a conversation without pressure.

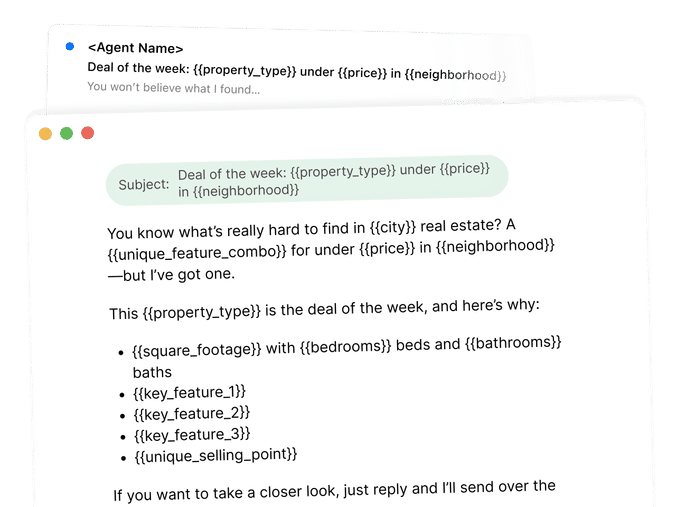

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Slow season? Only if you sit it out.

The best agents don’t wait for momentum. They create it.

And right now, the market just handed you a reason to re-engage homeowners in your database.

30-year mortgage rates just hit their lowest point since April.

Top agents use shifts like this to sharpen their timing and separate from the pack.

It seems like sellers everywhere want more than their home is worth right now.

Redfin just put numbers to what agents across North America have been saying for months: the typical seller is asking $39,000 more than buyers are willing to pay.

That’s the mindset we built this campaign to address.

Not by scaring people. But by walking them through a familiar (and avoidable) scenario: a high list price… a few quiet weeks… and eventually, a sale that costs them an extra $23K in holding costs they never planned for.

It’s a simple, clear way to illustrate why overpricing doesn’t just delay a sale—it eats away at their bottom line.

We based the $30K on a $700,000 home, factoring in two to three months of mortgage, taxes, insurance, and utilities. You can adjust the number to better reflect average home prices in your market.

It seems like sellers everywhere want more than their home is worth right now.

Redfin just put numbers to what agents across North America have been saying for months: the typical seller is asking $39,000 more than buyers are willing to pay.

That’s the mindset we built this campaign to address.

Not by scaring people. But by walking them through a familiar (and avoidable) scenario: a high list price… a few quiet weeks… and eventually, a sale that costs them an extra $23K in holding costs they never planned for.

It’s a simple, clear way to illustrate why overpricing doesn’t just delay a sale—it eats away at their bottom line.

We based the $23K on a $500,000 home, factoring in two to three months of mortgage, taxes, insurance, and utilities. You can adjust the number to better reflect average home prices in your market.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

The Bank of Canada may cut rates later this year—but buyers don’t need to wait on that to make progress. There are smart, practical ways to improve affordability right now.

The truth is, most consumers are leaving money on the table—simply because they haven’t been told what’s possible. As their agent, you can change that. You should change that.

Use this email to educate, empower, and move buyers off the sidelines with four proven rate strategies that work right now.

While rates are still high, the opportunity is hiding in plain sight: better strategy, not better timing.

The truth is, most consumers are leaving money on the table—simply because they haven’t been told what’s possible. As their agent, you can change that. You should change that.

According to Realtor.com, just shopping lenders could lower a rate by 0.86%. That’s real leverage—and it’s in your hands.

Use this email to educate, empower, and move buyers off the sidelines with four proven rate strategies that work right now.

We built this campaign around a financial blind spot that’s become impossible to ignore: the rising total cost of homeownership—and how it’s prompting more Canadians to reconsider staying put. A new Ratehub.ca report shows that in 2025, the average annual cost of owning a home in Canada—excluding mortgage payments—has climbed to over $21,000.

This email leans into that insight to meet clients where they are: feeling squeezed by property taxes, insurance, and upkeep. It speaks to the real questions homeowners are asking right now: Are we paying more to stay than we would to move?

The message does three things:

- Educates clients on the hidden and rising costs of ownership.

- Brings clarity by offering a framework for comparing today’s costs vs. tomorrow’s options.

- Provides next steps, with practical tools and a reassuring offer to help.

We’re not just selling homes—we’re helping people make smart, sustainable decisions.

We built this campaign around a growing pain point: first-time buyers and current homeowners often underestimate the true cost of homeownership. A recent Realtor.com report found that the top regret among first-time buyers is not getting better information about the full cost of owning a home. A Bankrate study echoes this, showing how quickly maintenance, repairs, and surprise expenses can add up.

We also know that many homeowners consider selling because those costs become too much to manage.

This email leans into those insights to do three things:

- Educate buyers and sellers on what to expect financially.

- Create transparency, removing friction by helping people understand what’s coming next.

- Offer next steps, showing up as a helpful guide if a move is on their mind.

By meeting people at the moment when financial questions start to surface, we position ourselves not just as agents — but as trusted advisors who lead with clarity.

The Bank of Canada held its key rate steady last week—keeping prime at 4.95% and leaving variable-rate borrowers unchanged for now.

But what happens next isn’t as clear. Markets are now expecting just one cut by year-end. Fixed rates are inching up. And depending on how inflation, jobs, and trade unfold this summer, mortgage rates could land anywhere from the low 3s to the high 4s.

This campaign helps you bring that uncertainty into focus. To offer clients real context, timely insight, and the kind of steady, informed guidance they’re looking for right now.

Homeowners pulled $25 billion in equity last quarter—the highest Q1 total since 2008, according to ICE Mortgage Technology.

Because they could.

HELOC rates have dropped by 2.5 percentage points. Tappable equity has hit $11.5 trillion. The average mortgage holder is sitting on over $200,000 in accessible cash—and many are starting to use it.

Some are renovating instead of relisting. Others are consolidating debt, boosting their buying power, or helping their kids into the market.

This campaign is about meeting that moment. Helping homeowners understand what they have, what it’s worth, and what they could do with it—whether they’re ready to move now or just exploring options.

When a new policy drops—especially one tied to affordability—it’s worth paying attention.

The federal government’s new GST rebate promises up to $50,000 in savings for first-time buyers of newly built homes under $1 million. On the surface, it sounds like a big win.

But here’s the truth: the fine print matters. Eligibility is narrow, impact is limited, and most buyers won’t qualify.

Still, this announcement gives you something valuable—a timely reason to reach out. To clarify what’s changed. To explain who it helps. And to show your clients you’re not just watching the news…you’re helping them understand what it means.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

Shannon Gillette recently put a spotlight on a familiar December dilemma on Instagram: Should you take your home off the market for the holidays? That's what inspired this campaign.

When many sellers pull their listings, the homes that stay active stand out and attract more serious attention. And buyers are still in the game - RE/MAX Canada reports that one-in-10 Canadians expect to buy a home in the next 12 months.

This timely campaign helps you show sellers the leverage hiding in the “slowdown” and guide them toward a clearer, more confident end-of-year decision.

Shannon Gillette recently put a spotlight on a familiar December dilemma: Should you take your home off the market for the holidays? That's what inspired this campaign.

When many sellers pause, the listings that stay active suddenly get more attention. And with mortgage rates sitting near their lowest point in a year - and an 8% jump in applications - buyers are still out there.

This timely campaign helps you show sellers the leverage hiding in the slowdown and guide them toward a clearer, more confident end-of-year decision.

Clarity is a power tool in this market. Your potential sellers are absorbing headline after headline, piecing together their own story about what’s happening (and that story usually leans negative). Whoever controls the narrative controls the market, and that's what we're doing here.

First, we mirror what many homeowners are already thinking: “Maybe we should wait to list.” That’s the hook that earns trust. Then we shift the energy with simple, data-backed reasons for optimism.

The campaign flows naturally into the three insights and a soft P.S. offering a home value check.

Clarity is a power tool in this market. Your potential sellers are absorbing headline after headline, piecing together their own story about what’s happening (and that story usually leans negative). Whoever controls the narrative controls the market, and that's what we're doing here.

First, we mirror what many homeowners are already thinking: “Maybe we should wait to list.” That’s the hook that earns trust. Then we shift the energy with simple, data-backed reasons for optimism.

The campaign flows naturally into the three insights and a soft P.S. offering a home value check.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

This is a simple spin-off of the original Name Your Price email - the same psychology, just delivered with a softer, more conversational entry point. Smart agents have already proven this strategy works in email and in direct mail, and the logic is straightforward: when a tactic consistently pulls, you double down on it.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

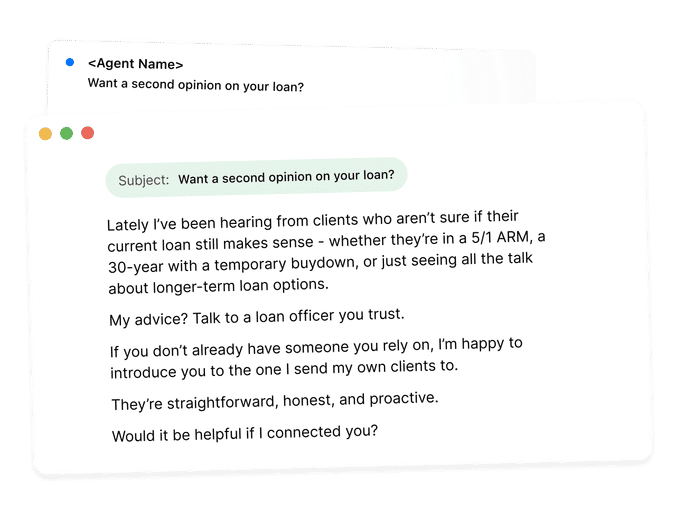

Real momentum happens when you stop waiting for perfect market conditions and start meeting people where their worries already are. And right now, borrowers are second-guessing everything - from their rates to their monthly payments to whether their loan still makes sense at all.

This is your cue to step in with clarity, not pressure. When you position yourself as the agent who connects clients to real answers - not sales pitches - you elevate trust faster than any market update ever could. People don’t want noise. They want someone who knows who to turn to and why.

That’s exactly why this campaign exists: to help you open that door, introduce your go-to loan officer, and guide your clients toward confident next steps with zero friction. Here’s how to put it into play.

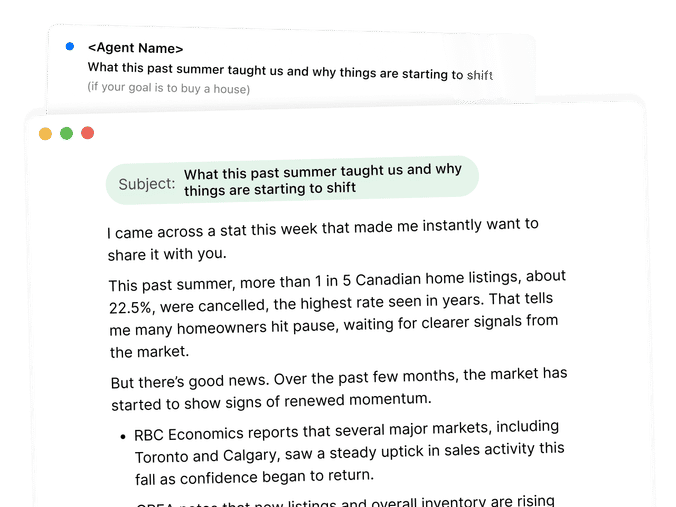

This message positions you as the trusted advisor who helps homeowners make sense of what’s happening — not just another agent pushing for a listing. It’s empathetic, data-driven, and designed to spark conversations with people who may have been thinking about selling but hit pause.

Just personalize the closing line and send it to your past clients, sphere, or homeowners in your farm. It’s an easy, high-trust touchpoint that can turn into your next listing opportunity.

This message positions you as the trusted advisor who helps homeowners make sense of what’s happening — not just another agent pushing for a listing. It’s empathetic, data-driven, and designed to spark conversations with people who may have been thinking about selling but hit pause.

Just personalize the closing line and send it to your past clients, sphere, or homeowners in your farm. It’s an easy, high-trust touchpoint that can turn into your next listing opportunity.

Most agents wait for homeowners to think about selling before they talk about home value. Big mistake.

Lower rates are back in the news, activity is ticking up, and homeowners in your database might be wondering what it means for their home.

This campaign removes the biggest objection right out of the gate (“but I’m not selling”) and makes it easy for homeowners to say yes to a simple, valuable update.

Home equity emails have always been top performers - but paired with today’s lower-rate momentum, they become even more powerful.

Use this campaign to reengage your database, deepen trust, and create new listing opportunities.

Most agents wait for homeowners to think about selling before they talk about home value. Big mistake.

Lower rates are back in the news, activity is ticking up, and homeowners in your database might be wondering what it means for their home.

This campaign removes the biggest objection right out of the gate (“but I’m not selling”) and makes it easy for homeowners to say yes to a simple, valuable update.

Home equity emails have always been top performers - but paired with today’s lower-rate momentum, they become even more powerful.

Use this campaign to reengage your database, deepen trust, and create new listing opportunities.

The real test in today’s market isn’t how fast you can land a deal...it’s how well you can hold it together once it’s on paper.

Inspections, financing, shifting buyer confidence… there are a hundred little moments where a deal can wobble. And that’s exactly where experience shows up.

This campaign leans into that truth. It spotlights the underrated (but absolutely essential) skill sellers are looking for right now: an agent who can keep the deal steady, calm the chaos, and see it through to closing.

We're using a technique in the subject line that we call "qualifying through copy." If they open the email, it signals some level of interest.

Follow up tomorrow with everyone who opens this email and send them this text.

Redfin just reported that 15% of home sales were canceled last month. That’s one in six. They crumbled during inspection negotiations, paperwork errors, and poor communication between parties.

That’s the real test right now: not how fast you can land a contract, but how well you can protect it once it’s signed.

This campaign leans into that truth. It spotlights the underrated (but absolutely essential) skill that sellers want in an agent right now: the ability to keep a deal together.

We're using a technique in the subject line that we call "qualifying through copy." If they open the email, it signals some level of interest.

Follow up tomorrow with everyone who opens this email and send them this text.

Right now, homes are sitting longer. Buyers see “60 days on market” and assume something’s off.

This campaign helps you reset that narrative. It gives buyers a smarter lens - one that separates true red flags from real opportunities.

Use this email to shift perception, build trust, and position yourself as the calm, data-driven guide every buyer needs (especially now).

Follow up tomorrow with everyone who opens this email and send them this text.

Confusion isn’t the enemy—silence is.

Right now, your clients don’t need all the answers. They need a trusted voice to help them make sense of the noise. This campaign is your opportunity to step in with calm, credible guidance at a time when most agents are staying quiet. Use it to:

• Acknowledge what buyers and sellers are really feeling

• Highlight what’s actually happening—rates, inventory, demand

• Reopen conversations that were paused out of fear or fatigue

Don’t wait for the market to “settle.” Show up for people now.

Most agents wait for certainty before they speak up. The best ones? They lead through it.

This campaign is designed for moments like this—when buyers and sellers are quietly re-evaluating, unsure whether to make a move or stay put. You have a short window to step in with clarity and confidence. Use this message to:

• Reignite conversations that have gone quiet

• Reframe what’s possible in the next 90 days

• Reposition yourself as the steady hand clients are searching for

It’s not about predicting the future. It’s about helping people make sense of the present.

Most agents ignore tax season. Smart ones use it to spark conversation.

When those new assessment letters hit mailboxes, homeowners do one of two things: shrug it off—or wonder if they’re getting overcharged. This campaign is built for the second group.

It positions you as the local expert who can translate inflated tax values into real-world numbers—and potentially real savings.

Use it to:

- Start value-based conversations without pushing a sale.

- Offer a helpful, relevant service that builds trust fast.

- Reconnect with past clients and neighbors in a way that feels timely and valuable.

Most agents wait for sellers to raise their hand. Top agents create the moment.

Right now, one of the most overlooked seller opportunities is hiding in plain sight: mortgage renewals. Thousands of homeowners are approaching renewal dates—and they’re quietly questioning whether staying put still makes financial sense.

This campaign meets them right there, in that moment of uncertainty.

Here’s how to use it to spark listing conversations:

- Lead with service—offer personalized insight, not a generic sales pitch.

- Frame the home equity report as a decision-making tool, not a valuation.

- Open the door to bigger conversations about upgrading, downsizing, or refinancing.

Most agents default to “now is a great time to buy”—but savvy buyers aren’t buying it.

They’ve seen the headlines. They know affordability is out of whack. What they don’t know is how to make sense of it all—or how to apply it to their own timeline. That’s the gap this campaign is built to fill.

This isn’t about hype. It’s about helping your clients zoom out, think long-term, and make a smart move based on their goals—not market noise.

Use this message to reset the conversation:

- Shift the narrative from timing to timeline.

- Show them how national data actually supports their local decision.

- Position yourself as the clear-thinking, truth-telling guide they’ve been looking for.

This week’s email is grounded in insights from RBC’s latest housing report and recent coverage from The Globe and Mail. Together, they capture a clear mood in the market: caution.

National resales fell nearly 10% in February—the sharpest monthly drop in years. But that stat alone doesn’t tell the whole story.

Because in a cautious market, people don’t stop moving. They just move differently.

This email helps you communicate that nuance—to show up as a calm, informed resource in a time when many are feeling uncertain.

This week’s email pulls from two of the most respected sources in housing data—Altos Research and ATTOM. Together, they paint a picture that’s more complex than the headlines suggest.

It’s a national view—but one that helps you frame local conversations with more clarity and confidence.

Because even when your market behaves differently, buyers and sellers are still hearing national narratives. Your job is to bring perspective.

Here’s what the latest numbers show—and how to use them to educate, inform, and stay relevant.

This template also includes a direct-response P.S. designed to surface potential sellers—so you can spark the right conversations at the right time.

Smart agents know that one Open House can lead to the next. Every buyer who walks through the door—whether they loved that home or not—is a lead who’s actively searching. So why not use that connection to keep them engaged?

This email works because it feels personal. It’s not a generic “Come to my Open House” blast—it’s an intentional, direct invitation. And by using the Deal of the Week strategy, you create curiosity without giving everything away. No full address. No full listing. Just enough intrigue to make them reply.

Use this as a simple but effective way to turn past Open House visitors into future clients. If they’re serious about buying, they’ll want the details.

A new report just dropped, and it’s the perfect opportunity to reach out to your database with valuable, timely information.

BNN Bloomberg just covered National Bank’s latest Housing Affordability Monitor, which shows that affordability in Canada improved for the fourth consecutive quarter. Rising incomes and lower mortgage rates are helping offset higher home prices, bringing mortgage payments to their lowest level as a percentage of income in nearly three years.

That’s a shift your audience needs to know about.

This email gives buyers a reason to re-evaluate their options and helps sellers understand what this means for demand. It positions you as the go-to resource for market insights while staying relevant and data-driven.

The latest research from Mike Simonsen, founder of Altos Research, reveals a major shift: new listings are up 14% year over year, the highest mid-March inventory levels since 2020. That’s data your database needs to hear.

When you consistently share market insights, you position yourself as the go-to expert—someone clients trust long before they’re ready to buy or sell. That’s why we’ve crafted this value-first email for you. It delivers key market trends in a way that’s easy to digest and keeps you top-of-mind.

Most agents think trust is built in big moments—an incredible listing presentation, a perfectly staged home, a well-executed negotiation. But trust isn’t a switch you flip. It’s a slow burn. It’s built in the moments when you’re not selling, just showing up with value.

That’s what this email does. No push. No pressure. Just sharp market insights your clients will appreciate. Over time, these touchpoints add up. They create familiarity, confidence, and—when the time is right—a listing opportunity.

ListingLeads member Anthony Malafronte saw it firsthand:

"Three new listings are coming on in the next couple of weeks! All using these tools and tactics. One we cultivated through email only, the owner is hearing impaired (the best listing appointment I have ever been on), I'm not sure we'd have made it happen without this group. When we met, the owner felt comfortable with our commitment to the business, our knowledge of the market, and our ability to market his home. The consistency with which we shared info, and weren't annoying but smart and helpful. Was what he shared with us."

This email was inspired by a recent Redfin article highlighting a surge in homebuyer interest. Market activity is shifting, and staying in front of your clients with timely, relevant insights is how you build trust—long before they’re ready to make a move

Most agents think trust is built in big moments—an incredible listing presentation, a perfectly staged home, a well-executed negotiation. But trust isn’t a switch you flip. It’s a slow burn. It’s built in the moments when you’re not selling, just showing up with value.

That’s what this email does. No push. No pressure. Just sharp market insights your clients will appreciate. Over time, these touchpoints add up. They create familiarity, confidence, and—when the time is right—a listing opportunity.

ListingLeads member Anthony Malafronte saw it firsthand:

"Three new listings are coming on in the next couple of weeks! All using these tools and tactics. One we cultivated through email only, the owner is hearing impaired (the best listing appointment I have ever been on), I'm not sure we'd have made it happen without this group. When we met, the owner felt comfortable with our commitment to the business, our knowledge of the market, and our ability to market his home. The consistency with which we shared info, and weren't annoying but smart and helpful. Was what he shared with us."

This email was crafted by pulling insights from recent articles in The Financial Post, The Globe & Mail, and BNN Bloomberg. The Bank of Canada has cut rates seven times, yet demand hasn’t surged to match. Buyers are cautious, and the market is shifting in ways that create new opportunities.

Staying in front of your clients with timely, relevant insights is how you build trust—long before they’re ready to make a move.

Let’s get into it.

It’s okay to feel uncertain right now. Your clients are feeling it, and if you’re being honest, you probably are too. The constant headlines—trade tensions, tariffs, economic shifts—make it hard to know what’s next. And when things feel unpredictable, it’s natural to hesitate.

But uncertainty doesn’t mean pressing pause. It means leaning into what doesn’t change—your expertise, your ability to guide, and the trust you’ve built with your clients. They don’t need all the answers right now. They just need someone who can help them understand their options and make decisions with confidence.

Mortgage demand just jumped 20% in a single week. That’s not just a number—it’s a signal.

Buyers are paying attention. A dip in rates has pulled more of them back into the market, and that momentum could mean more competition, stronger offers, and better opportunities for sellers.

Real estate moves in cycles, and smart buyers and sellers move with it. The key is knowing when to act.

Here’s what this shift means for your clients—and how you can help them stay ahead.

Most FSBO sellers think the hardest part is getting an offer. But in reality? The toughest part is knowing what to do next.

Many sellers assume price is all that matters. But once the offers start rolling in, they realize there’s a lot more at stake—hidden costs, contingencies, and tricky negotiations that can cost them thousands. The problem? FSBO sellers don’t always see these pitfalls coming until it’s too late.

This email positions you as the guide they didn’t know they needed. By educating them upfront and offering a free CMA, you’re not just providing value—you’re giving them the clarity and confidence they won’t get from an online estimate. No sales pitch, just real help. And when they hit a roadblock? You might be the first person they think to call.

.svg)