My Favorites

This campaign is a spin on the proven Magic Buyer strategy—specifically tailored for your clients who are looking for an investment opportunity.

You’re still leveraging real buyer demand to spark off-market conversations, but the message is tailored to homeowners that have properties that need to be renovated.

Tiffany Vasquez sent 88 Magic Buyer Letters and got 15 responses, 10 interested homeowners, and 5 potential listings.

Tre Serrano sent 50 and walked away with 2 listings.

This letter delivers the same results by focusing on what works: a real buyer and a message that feels personal, specific, and low-pressure.

More Canadian homeowners are tapping into their equity this year—driven by rising renewal volumes, increased HELOC usage, and a growing need to make smart financial decisions without giving up a low-rate mortgage.

That makes this the perfect time to bring back a strategy that’s worked exceptionally well: the unsolicited CMA.

Reach out to 5–10 people in your sphere or past clients with a quick, personalized equity update—no ask, no pressure, just timely insight.The text below helps you start the conversation—and positions you as the steady, informed guide they want in their corner.

The Bank of Canada held its key rate steady last week—keeping prime at 4.95% and leaving variable-rate borrowers unchanged for now.

But what happens next isn’t as clear. Markets are now expecting just one cut by year-end. Fixed rates are inching up. And depending on how inflation, jobs, and trade unfold this summer, mortgage rates could land anywhere from the low 3s to the high 4s.

This campaign helps you bring that uncertainty into focus. To offer clients real context, timely insight, and the kind of steady, informed guidance they’re looking for right now.

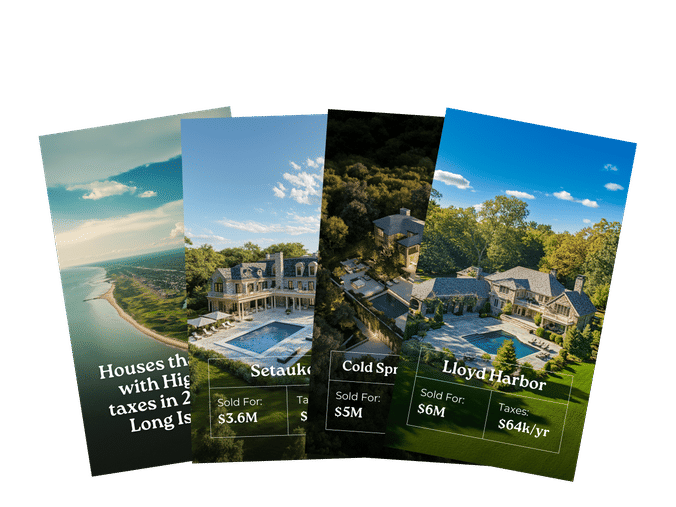

This Reel was inspired by a viral post from Lucky to Live Here:

“Houses that sold with the highest taxes in 2025 on Long Island.”

It’s hyper-local, data-driven, and built for curiosity clicks.

We’ve turned that idea into a customizable Instagram Reel template for your market.

Pick the hook that fits your area best:

→ The steepest price cuts

→ The highest taxes

→ The longest or shortest days on market

→ The highest monthly payments

Then showcase 3–4 recent sales with that stat front and center. Quick to make, easy to engage—and a smart way to start conversations

When you’ve sold a few homes in the same neighborhood, something shifts. You don’t just know the market—you know the buyers, the timing, and what it takes to get a deal done.

This postcard is designed to capitalize on that kind of momentum.

It opens with a confident question—Why are so many of your neighbors hiring me?—then delivers proof: multiple nearby sales, strong results, and a compelling offer that flips the usual listing pitch.

It’s direct, credible, and built to spark conversations.

Pro tip: Follow up with a Magic Buyer Letter for anyone who shows interest—include real numbers, real stories, and a reason to call you back.

This one’s built to spark engagement—and get your clients thinking.

Homeowners pulled $25B in equity last quarter, the highest Q1 total since 2008. On average, they’re sitting on over $200K in tappable equity. (Source: ICE Mortgage Tech)

Use this poll to start a bigger conversation: What could your equity actually do for you?

It’s a soft entry point into deeper DMs—and a perfect opportunity to follow up with anyone who responds with an offer to prepare an updated equity report, no strings attached.

$25 billion in equity was pulled last quarter—the highest Q1 total since 2008, according to ICE Mortgage Technology. And the average U.S. homeowner is now sitting on over $200K in tappable equity.

That makes this the perfect time to bring back a strategy that’s worked time and time again: the unsolicited CMA.

Reach out to 5–10 people in your sphere or past clients with a quick, personalized equity update.

The text below makes it easy to start the conversation—and reminds them exactly why they trust you.

Homeowners pulled $25 billion in equity last quarter—the highest Q1 total since 2008, according to ICE Mortgage Technology.

Because they could.

HELOC rates have dropped by 2.5 percentage points. Tappable equity has hit $11.5 trillion. The average mortgage holder is sitting on over $200,000 in accessible cash—and many are starting to use it.

Some are renovating instead of relisting. Others are consolidating debt, boosting their buying power, or helping their kids into the market.

This campaign is about meeting that moment. Helping homeowners understand what they have, what it’s worth, and what they could do with it—whether they’re ready to move now or just exploring options.

1 in 7 deals fell apart last month. (Redfin)

Not offers that never came in. Contracts that were accepted—and then canceled.

That stat alone gives you a reason to speak up. Because behind every canceled deal is a question your clients are already asking: Is now still a good time to buy or sell?

This video gives you a calm, data-backed way to answer it.

You’ll walk buyers through the silver linings. Show sellers where the leverage still exists. And offer a neighborhood-level perspective most agents never take the time to explain.

If you’re looking for a smart, steady way to show up this week—this is it.

Price drops are happening for a reason.

Some homes were overpriced. Some sellers misread the market.

But for buyers? That shift creates opportunity.

This Instagram Story leans into what’s actually happening—without sugarcoating it. It gives buyers a reason to engage, and gives you a simple way to start real conversations based on real-time changes in the market.

Here’s the post—just plug in the neighborhood:

“This is 1 of 4 homes that just had a price drop…

…in one of the hottest neighborhoods in [City Name].

Should I send you the other 3?? They're all priced below recent comps.”

→ Yes, I’m curious → Show me the deals

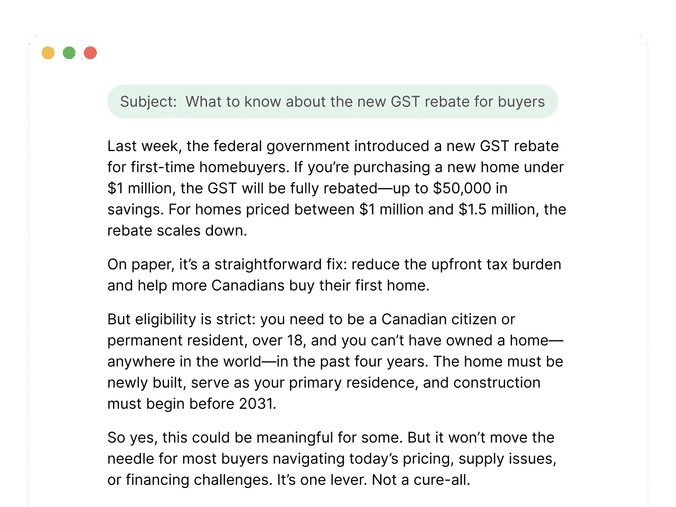

When a new policy drops—especially one tied to affordability—it’s worth paying attention.

The federal government’s new GST rebate promises up to $50,000 in savings for first-time buyers of newly built homes under $1 million. On the surface, it sounds like a big win.

But here’s the truth: the fine print matters. Eligibility is narrow, impact is limited, and most buyers won’t qualify.

Still, this announcement gives you something valuable—a timely reason to reach out. To clarify what’s changed. To explain who it helps. And to show your clients you’re not just watching the news…you’re helping them understand what it means.

14.3% of deals were canceled in April.

That’s not just a headline—it’s a conversation starter. And this letter is designed to turn that market reality into a moment of connection with sellers who’ve pulled their homes off the market.

We’re not pitching. We’re not pressuring. We’re showing up with empathy, insight, and a clear reason to reach out right now.

This campaign works because it meets the seller where they are:

→ Discouraged but not done

→ Skeptical, but still open

→ Burned out, but hoping for a better plan

It validates their experience, shows you’ve done your homework, and makes a thoughtful offer—without asking for anything in return.

Send this to homeowners who canceled, expired, or withdrew their listings this spring.

Here’s how you generate more listings: Have more relevant conversations—consistently.

Most agents study the market daily. But few take that insight and share it directly with the people who care most: the homeowners in their sphere.

That’s what this text is for. It’s a simple 1:1 market update. Easy to digest. Personalized. Timely. And best of all—it gives you a natural reason to reach out at the start of each month.

Need a hook? Here are 5 ways to open the conversation:

- “I just saw 123 Main Street sold in your neighborhood.”

- “I noticed 123 Main Street had a price reduction recently.”

- “Looks like 3 homes near you hit the market last week.”

- “I saw inventory in your neighborhood is up 32% compared to this time last year.”

- “A home down the street just went under contract after sitting for 60 days.”

Each one flows naturally into: “Would it be helpful if I sent over a quick market update from May?”

You’re already reviewing the May data. So while it’s fresh, send 5 of these texts today.

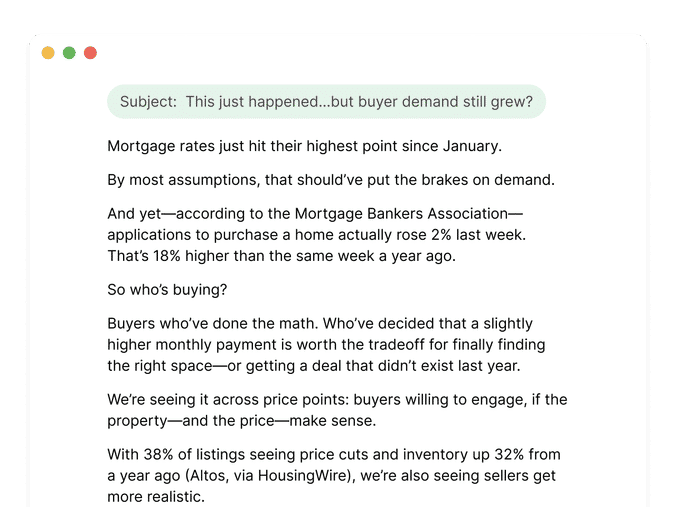

When you see a stat like this—

Mortgage demand is up 18% year-over-year, even with rates at their highest since January—that’s your green light to hit send. (Source: CNBC)

Because now, you’re not just emailing to stay in touch.

You’re emailing with relevance and value.

And if you imagine sitting across from a thoughtful, financially savvy client—the kind who tracks headlines but appreciates real context—this is exactly the kind of timely information they’re counting on you to deliver.

This campaign gives you the perfect entry point to re-engage your buyers, reframe the opportunity for sellers, and remind your database that you’re the one watching the trends—and making sense of what they actually mean.

This letter is built for one purpose: to help you start meaningful conversations with homeowners as we head into the summer season.

It’s an updated variation of Reasons Why People Are Selling This Summer—the campaign Gretchen Coley used to generate a $2.1M listing that sold in just two weeks.

The message is timely, relevant, and direct. It speaks to what sellers are actually thinking about right now: rates, timing, uncertainty, and whether it’s still a good time to sell.

Use this version to establish a new farm—or re-engage an existing one.

Just don’t forget to personalize:

- Include your local days on market

- Add real data about home values or recent activity

- Keep the call to action clear and simple

Direct mail doesn’t need 12 months to work. It just needs the right message at the right time.

Selling a home is rarely as simple—or as fast—as people expect.

That’s why we created this carousel: to walk future sellers through what the process actually feels like. The decisions, the doubts, the waiting, the wins.

It’s not meant to capture every scenario. Instead, it offers a realistic, emotionally honest timeline to help set better expectations—especially in a market where things are taking longer and patience matters more than ever.

Just one note: you’ll want to edit Slide 7 to reflect the average days on market in your area.Use it as-is—or tweak the timeline to better fit what you’re seeing with your clients.