Email Campaigns

When you see a stat like this—

Mortgage demand is up 18% year-over-year, even with rates at their highest since January—that’s your green light to hit send. (Source: CNBC)

Because now, you’re not just emailing to stay in touch.

You’re emailing with relevance and value.

And if you imagine sitting across from a thoughtful, financially savvy client—the kind who tracks headlines but appreciates real context—this is exactly the kind of timely information they’re counting on you to deliver.

This campaign gives you the perfect entry point to re-engage your buyers, reframe the opportunity for sellers, and remind your database that you’re the one watching the trends—and making sense of what they actually mean.

Most agents wait for a signal—"We're thinking of moving"—before offering value. But the smart play? Lead with insight, not invitation.

This email works because it flips the script:

- It removes the pressure to sell.

- It positions you as a financial guide, not a salesperson.

- It builds trust by showing the work you do behind the scenes.

- And it taps into a powerful truth: people want to know where they stand… especially when everyone else is wondering the same thing.

Send it. Spark the conversation. Then follow up with a personal text.

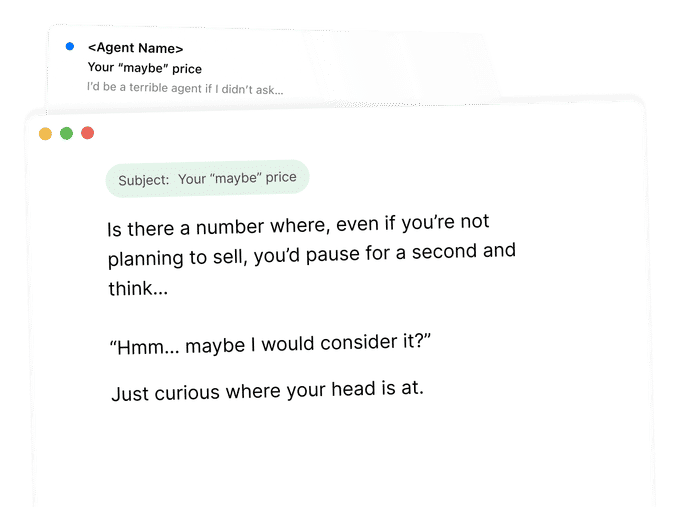

Most agents overthink lead generation.

They build funnels. Hire videographers. Try to automate trust.

But sometimes? The highest-converting strategy is just… asking a smart question.

That’s what this campaign does.

It worked on social—because it’s personal. Disarming.

So we brought it to email, too.

Here’s why it works:

- It meets sellers where they are—in hesitation, not decision.

- It’s frictionless—easy to answer.

- It starts a conversation you can actually convert.

The market isn’t as chaotic as it used to be. And it’s giving buyers something they haven’t had in years: options.

Homes are sitting longer. Bidding wars are cooling. And buyers are starting to realize they have more room to breathe—and negotiate.

This campaign helps you reframe the narrative.

Not with hype. Not with urgency. But with insight.

Bright MLS data shows nearly 40% of buyers found a home in under 30 days—and half only made one offer.

That’s a massive shift from the chaos of the past few years.

This campaign helps you reframe the narrative.

Not with hype. Not with urgency. But with insight.

This campaign was inspired by a new report from ATTOM analyzing 47 million home sales over the past decade. The data points to one clear trend: homes that close in May sell for the highest premium—on average, 9.5% above market value.

That kind of insight doesn’t push someone to list tomorrow—but it does plant a seed.

Most sellers take weeks, even months, to make a move. Which means timely, relevant data like this helps you show up early—before they’re even raising their hand.

Use it to educate, build trust, and stay in their corner until the timing feels right.

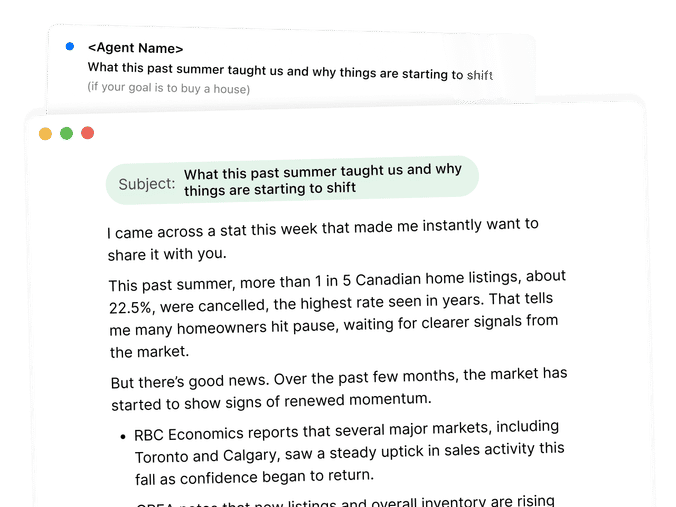

This campaign was inspired by a recent Financial Post interview with veteran mortgage broker Ron Butler, who called this “maybe the softest spring market in decades.” Then he said something most people wouldn’t expect: “And that might actually be a good thing.”

That’s the opening we ran with.

Because slower doesn’t mean stalled—and soft doesn’t mean broken. This email gives your audience a clearer lens: one that helps them see today’s market as something to better understand.

Use it to reframe the conversation, bring steady perspective, and remind your database that strategy still wins—especially in markets like this.

This follow-up campaign is designed for attendees of your seller seminar — and it works just as well as a handwritten note or email. It’s not a pitch. It’s a thank you.

The goal here is simple: reinforce the value of the event, acknowledge the complexity of the selling process, and position yourself as a steady, trusted resource. For Silver Tsunami sellers, clarity matters just as much as timing — and this message helps you stay top-of-mind without pushing for a decision.

This version of the Anti-Fear Campaign is built specifically for declining markets. It helps Silver Tsunami sellers zoom out and see the bigger picture: the decades of equity they’ve built, the financial cushion they still have, and the flexibility they’ve earned.

When the headlines scream collapse, this message brings calm. It reframes fear with facts, and reminds longtime owners that even in a down market, they’re not starting from zero — they’re starting from strength.

Fear-based headlines get clicks. But they don’t help your clients make clear, confident decisions.

This campaign is designed to counter the noise with calm, credible context — especially for longtime homeowners who remember 2008 and worry we’re heading there again.

You’ll use data from major financial institutions to reframe the narrative and bring reassurance to sellers who are watching the market but unsure what to believe. It’s not about hype. It’s about perspective — and positioning yourself as the steady guide in a noisy moment.

ResiClub just dropped a breakdown every agent should see: 33.9% of active listings in March had a price cut—the highest share in years.

At first glance, it might feel like a warning sign. But zoom out, and the picture changes. Even during the 2021 buying frenzy, nearly 1 in 5 listings adjusted their price.

This isn’t about panic—it’s about how you coach clients through the shift:

— Show them why price cuts don’t always signal weakness

— Reframe expectations around timing, negotiation, and demand

— Be the calm in the chaos

This campaign gives you the data—and the script—to do exactly that.

More listings are getting price cuts this spring—but what that means depends entirely on how you explain it.

Look at the data in your local market to figure out how many homes took a price cut last month. Plug that into this template.

The stat is important. But the story you tell around it? That’s what builds trust.

This isn’t about panic—it’s about how you coach clients through the shift:

— Show them why price cuts don’t always signal weakness

— Reframe expectations around timing, negotiation, and demand

— Be the calm in the chaos

This campaign gives you the data—and the script—to do exactly that.

Most agents send a Just Sold once—right after the deal closes. Then they move on.

But here’s the truth: you can send it weeks (even months) later and still spark listing appointments. Why? Because what sellers need isn’t just a headline—they need to see how you got the result.

This email campaign does exactly that. It walks readers through the full story of the sale: why the sellers reached out, how you prepped the home, the pricing strategy, marketing plan, negotiation, and final outcome. Step by step. Real. Relatable. Strategic.

When you show the work behind the win, you don’t just get credit—you get calls.

Here’s a pro tip that can transform your listing pitch—and your lead gen.

Every time you walk into a new listing, snap a few iPhone photos. The worse, the better. When the pro shots come back, you’ll have a clean before-and-after—same angle, same room, completely different story.

Then? Turn it into an email campaign like this one.

Because when sellers see the difference prep and presentation make, they stop asking about price—and start asking how you got that result. This is how you turn one win into your next three listings.

The Bank of Canada hit pause—holding the policy rate at 2.75% for the first time in a year.

That move might seem small. But for your clients, it creates a big question mark. Rates didn’t drop. Confidence didn’t return. And headlines didn’t get any clearer.

Which means your role just got more important.

Right now, buyers and sellers are waiting for someone to help them interpret what this actually means. Use this campaign to do exactly that—to be the voice of calm, clarity, and next steps in a market full of mixed signals.

A brand-new survey from Realtor.com, released April 14, reveals something surprising: 70% of potential sellers still believe it’s a good time to sell.

On the surface, that might seem disconnected from reality—especially with consumer confidence at a 12-year low and recession fears looming.

But sellers aren’t waiting for perfect conditions. They’re driven by life events, equity gains, and the urgency to move forward.

Even now, we’re selling over 12,000 homes a day.

This campaign helps you speak directly to that motivated seller—the one who needs clarity.

Keep your head in the game. The consumer needs you more than ever.

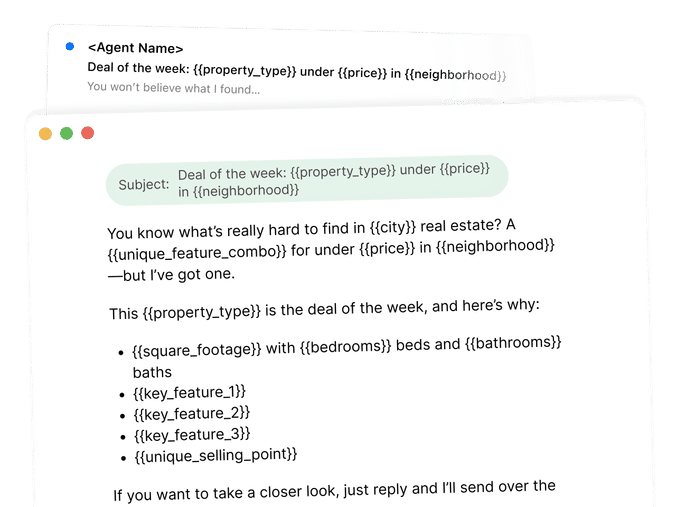

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

Shannon Gillette recently put a spotlight on a familiar December dilemma on Instagram: Should you take your home off the market for the holidays? That's what inspired this campaign.

When many sellers pull their listings, the homes that stay active stand out and attract more serious attention. And buyers are still in the game - RE/MAX Canada reports that one-in-10 Canadians expect to buy a home in the next 12 months.

This timely campaign helps you show sellers the leverage hiding in the “slowdown” and guide them toward a clearer, more confident end-of-year decision.

Shannon Gillette recently put a spotlight on a familiar December dilemma: Should you take your home off the market for the holidays? That's what inspired this campaign.

When many sellers pause, the listings that stay active suddenly get more attention. And with mortgage rates sitting near their lowest point in a year - and an 8% jump in applications - buyers are still out there.

This timely campaign helps you show sellers the leverage hiding in the slowdown and guide them toward a clearer, more confident end-of-year decision.

Clarity is a power tool in this market. Your potential sellers are absorbing headline after headline, piecing together their own story about what’s happening (and that story usually leans negative). Whoever controls the narrative controls the market, and that's what we're doing here.

First, we mirror what many homeowners are already thinking: “Maybe we should wait to list.” That’s the hook that earns trust. Then we shift the energy with simple, data-backed reasons for optimism.

The campaign flows naturally into the three insights and a soft P.S. offering a home value check.

Clarity is a power tool in this market. Your potential sellers are absorbing headline after headline, piecing together their own story about what’s happening (and that story usually leans negative). Whoever controls the narrative controls the market, and that's what we're doing here.

First, we mirror what many homeowners are already thinking: “Maybe we should wait to list.” That’s the hook that earns trust. Then we shift the energy with simple, data-backed reasons for optimism.

The campaign flows naturally into the three insights and a soft P.S. offering a home value check.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

This is a simple spin-off of the original Name Your Price email - the same psychology, just delivered with a softer, more conversational entry point. Smart agents have already proven this strategy works in email and in direct mail, and the logic is straightforward: when a tactic consistently pulls, you double down on it.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Not sure which listing to feature?

- Filter for new listings (within the last 7 days)

- Focus on your target price point

- Stay in your ideal neighborhood or farm area

That should give you a pool of 50–70 listings.

From there, zero in on the one with the highest saves or views—that’s your deal of the week.

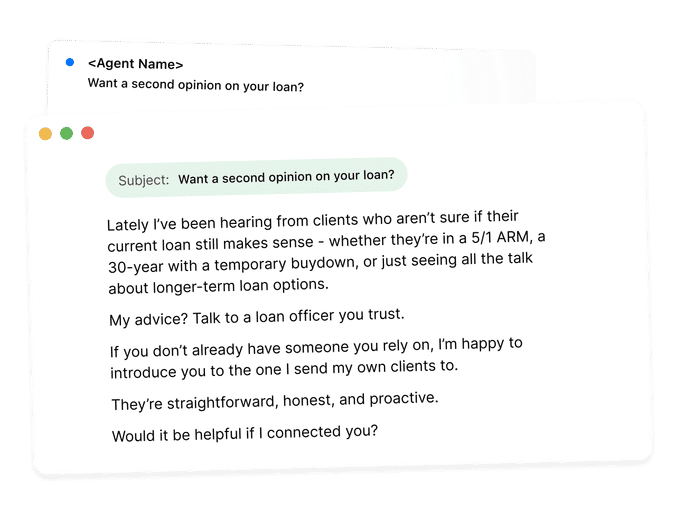

Real momentum happens when you stop waiting for perfect market conditions and start meeting people where their worries already are. And right now, borrowers are second-guessing everything - from their rates to their monthly payments to whether their loan still makes sense at all.

This is your cue to step in with clarity, not pressure. When you position yourself as the agent who connects clients to real answers - not sales pitches - you elevate trust faster than any market update ever could. People don’t want noise. They want someone who knows who to turn to and why.

That’s exactly why this campaign exists: to help you open that door, introduce your go-to loan officer, and guide your clients toward confident next steps with zero friction. Here’s how to put it into play.

This message positions you as the trusted advisor who helps homeowners make sense of what’s happening — not just another agent pushing for a listing. It’s empathetic, data-driven, and designed to spark conversations with people who may have been thinking about selling but hit pause.

Just personalize the closing line and send it to your past clients, sphere, or homeowners in your farm. It’s an easy, high-trust touchpoint that can turn into your next listing opportunity.

This message positions you as the trusted advisor who helps homeowners make sense of what’s happening — not just another agent pushing for a listing. It’s empathetic, data-driven, and designed to spark conversations with people who may have been thinking about selling but hit pause.

Just personalize the closing line and send it to your past clients, sphere, or homeowners in your farm. It’s an easy, high-trust touchpoint that can turn into your next listing opportunity.

Most agents wait for homeowners to think about selling before they talk about home value. Big mistake.

Lower rates are back in the news, activity is ticking up, and homeowners in your database might be wondering what it means for their home.

This campaign removes the biggest objection right out of the gate (“but I’m not selling”) and makes it easy for homeowners to say yes to a simple, valuable update.

Home equity emails have always been top performers - but paired with today’s lower-rate momentum, they become even more powerful.

Use this campaign to reengage your database, deepen trust, and create new listing opportunities.

Most agents wait for homeowners to think about selling before they talk about home value. Big mistake.

Lower rates are back in the news, activity is ticking up, and homeowners in your database might be wondering what it means for their home.

This campaign removes the biggest objection right out of the gate (“but I’m not selling”) and makes it easy for homeowners to say yes to a simple, valuable update.

Home equity emails have always been top performers - but paired with today’s lower-rate momentum, they become even more powerful.

Use this campaign to reengage your database, deepen trust, and create new listing opportunities.

The real test in today’s market isn’t how fast you can land a deal...it’s how well you can hold it together once it’s on paper.

Inspections, financing, shifting buyer confidence… there are a hundred little moments where a deal can wobble. And that’s exactly where experience shows up.

This campaign leans into that truth. It spotlights the underrated (but absolutely essential) skill sellers are looking for right now: an agent who can keep the deal steady, calm the chaos, and see it through to closing.

We're using a technique in the subject line that we call "qualifying through copy." If they open the email, it signals some level of interest.

Follow up tomorrow with everyone who opens this email and send them this text.

Redfin just reported that 15% of home sales were canceled last month. That’s one in six. They crumbled during inspection negotiations, paperwork errors, and poor communication between parties.

That’s the real test right now: not how fast you can land a contract, but how well you can protect it once it’s signed.

This campaign leans into that truth. It spotlights the underrated (but absolutely essential) skill that sellers want in an agent right now: the ability to keep a deal together.

We're using a technique in the subject line that we call "qualifying through copy." If they open the email, it signals some level of interest.

Follow up tomorrow with everyone who opens this email and send them this text.

Right now, homes are sitting longer. Buyers see “60 days on market” and assume something’s off.

This campaign helps you reset that narrative. It gives buyers a smarter lens - one that separates true red flags from real opportunities.

Use this email to shift perception, build trust, and position yourself as the calm, data-driven guide every buyer needs (especially now).

Follow up tomorrow with everyone who opens this email and send them this text.

When interest rates so much as wobble, buyer psychology shifts. Not always in ways you can predict—but often in ways you can use. A modest dip doesn’t just increase affordability. It gives fence-sitters permission to act.

With the Bank of Canada’s next rate announcement coming July 30, now is the time to steady your message.

This email helps you do just that—calmly, confidently, and with purpose.

Send this email today and include a soft P.S. to invite the right people into a conversation without pressure.

A subtle shift in rates can unlock serious momentum.

When mortgage rates ease—even slightly—buyers don’t just gain affordability. They gain confidence. According to Redfin, a recent dip from 7.08% to 6.67% gave buyers with a $3,000/month budget $16,000 more in purchasing power—enough to afford a $455,000 home instead of $439,000.

That kind of shift can often spark renewed energy: faster tours, fewer concessions, more decisive offers.

Send this email today and include a soft P.S. to invite the right people into a conversation without pressure.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

Slow season? Only if you sit it out.

The best agents don’t wait for momentum. They create it.

And right now, the market just handed you a reason to re-engage homeowners in your database.

30-year mortgage rates just hit their lowest point since April.

Top agents use shifts like this to sharpen their timing and separate from the pack.

It seems like sellers everywhere want more than their home is worth right now.

Redfin just put numbers to what agents across North America have been saying for months: the typical seller is asking $39,000 more than buyers are willing to pay.

That’s the mindset we built this campaign to address.

Not by scaring people. But by walking them through a familiar (and avoidable) scenario: a high list price… a few quiet weeks… and eventually, a sale that costs them an extra $23K in holding costs they never planned for.

It’s a simple, clear way to illustrate why overpricing doesn’t just delay a sale—it eats away at their bottom line.

We based the $30K on a $700,000 home, factoring in two to three months of mortgage, taxes, insurance, and utilities. You can adjust the number to better reflect average home prices in your market.

It seems like sellers everywhere want more than their home is worth right now.

Redfin just put numbers to what agents across North America have been saying for months: the typical seller is asking $39,000 more than buyers are willing to pay.

That’s the mindset we built this campaign to address.

Not by scaring people. But by walking them through a familiar (and avoidable) scenario: a high list price… a few quiet weeks… and eventually, a sale that costs them an extra $23K in holding costs they never planned for.

It’s a simple, clear way to illustrate why overpricing doesn’t just delay a sale—it eats away at their bottom line.

We based the $23K on a $500,000 home, factoring in two to three months of mortgage, taxes, insurance, and utilities. You can adjust the number to better reflect average home prices in your market.

Want us to automate the Deal of the Week for you every week? Try out AI Mode.

The Deal of the Week strategy needs to be added to your weekly marketing SOPs. It's simple, repeatable, and highly effective.

Use the template we provided below to send out your Deal of the Week, use this free tool to write the email and send it yourself, or get AI Mode to automate the entire process for you.

The Bank of Canada may cut rates later this year—but buyers don’t need to wait on that to make progress. There are smart, practical ways to improve affordability right now.

The truth is, most consumers are leaving money on the table—simply because they haven’t been told what’s possible. As their agent, you can change that. You should change that.

Use this email to educate, empower, and move buyers off the sidelines with four proven rate strategies that work right now.

While rates are still high, the opportunity is hiding in plain sight: better strategy, not better timing.

The truth is, most consumers are leaving money on the table—simply because they haven’t been told what’s possible. As their agent, you can change that. You should change that.

According to Realtor.com, just shopping lenders could lower a rate by 0.86%. That’s real leverage—and it’s in your hands.

Use this email to educate, empower, and move buyers off the sidelines with four proven rate strategies that work right now.

We built this campaign around a financial blind spot that’s become impossible to ignore: the rising total cost of homeownership—and how it’s prompting more Canadians to reconsider staying put. A new Ratehub.ca report shows that in 2025, the average annual cost of owning a home in Canada—excluding mortgage payments—has climbed to over $21,000.

This email leans into that insight to meet clients where they are: feeling squeezed by property taxes, insurance, and upkeep. It speaks to the real questions homeowners are asking right now: Are we paying more to stay than we would to move?

The message does three things:

- Educates clients on the hidden and rising costs of ownership.

- Brings clarity by offering a framework for comparing today’s costs vs. tomorrow’s options.

- Provides next steps, with practical tools and a reassuring offer to help.

We’re not just selling homes—we’re helping people make smart, sustainable decisions.

We built this campaign around a growing pain point: first-time buyers and current homeowners often underestimate the true cost of homeownership. A recent Realtor.com report found that the top regret among first-time buyers is not getting better information about the full cost of owning a home. A Bankrate study echoes this, showing how quickly maintenance, repairs, and surprise expenses can add up.

We also know that many homeowners consider selling because those costs become too much to manage.

This email leans into those insights to do three things:

- Educate buyers and sellers on what to expect financially.

- Create transparency, removing friction by helping people understand what’s coming next.

- Offer next steps, showing up as a helpful guide if a move is on their mind.

By meeting people at the moment when financial questions start to surface, we position ourselves not just as agents — but as trusted advisors who lead with clarity.

The Bank of Canada held its key rate steady last week—keeping prime at 4.95% and leaving variable-rate borrowers unchanged for now.

But what happens next isn’t as clear. Markets are now expecting just one cut by year-end. Fixed rates are inching up. And depending on how inflation, jobs, and trade unfold this summer, mortgage rates could land anywhere from the low 3s to the high 4s.

This campaign helps you bring that uncertainty into focus. To offer clients real context, timely insight, and the kind of steady, informed guidance they’re looking for right now.

Homeowners pulled $25 billion in equity last quarter—the highest Q1 total since 2008, according to ICE Mortgage Technology.

Because they could.

HELOC rates have dropped by 2.5 percentage points. Tappable equity has hit $11.5 trillion. The average mortgage holder is sitting on over $200,000 in accessible cash—and many are starting to use it.

Some are renovating instead of relisting. Others are consolidating debt, boosting their buying power, or helping their kids into the market.

This campaign is about meeting that moment. Helping homeowners understand what they have, what it’s worth, and what they could do with it—whether they’re ready to move now or just exploring options.

When a new policy drops—especially one tied to affordability—it’s worth paying attention.

The federal government’s new GST rebate promises up to $50,000 in savings for first-time buyers of newly built homes under $1 million. On the surface, it sounds like a big win.

But here’s the truth: the fine print matters. Eligibility is narrow, impact is limited, and most buyers won’t qualify.

Still, this announcement gives you something valuable—a timely reason to reach out. To clarify what’s changed. To explain who it helps. And to show your clients you’re not just watching the news…you’re helping them understand what it means.

When you see a stat like this—

Mortgage demand is up 18% year-over-year, even with rates at their highest since January—that’s your green light to hit send. (Source: CNBC)

Because now, you’re not just emailing to stay in touch.

You’re emailing with relevance and value.

And if you imagine sitting across from a thoughtful, financially savvy client—the kind who tracks headlines but appreciates real context—this is exactly the kind of timely information they’re counting on you to deliver.

This campaign gives you the perfect entry point to re-engage your buyers, reframe the opportunity for sellers, and remind your database that you’re the one watching the trends—and making sense of what they actually mean.

.svg)